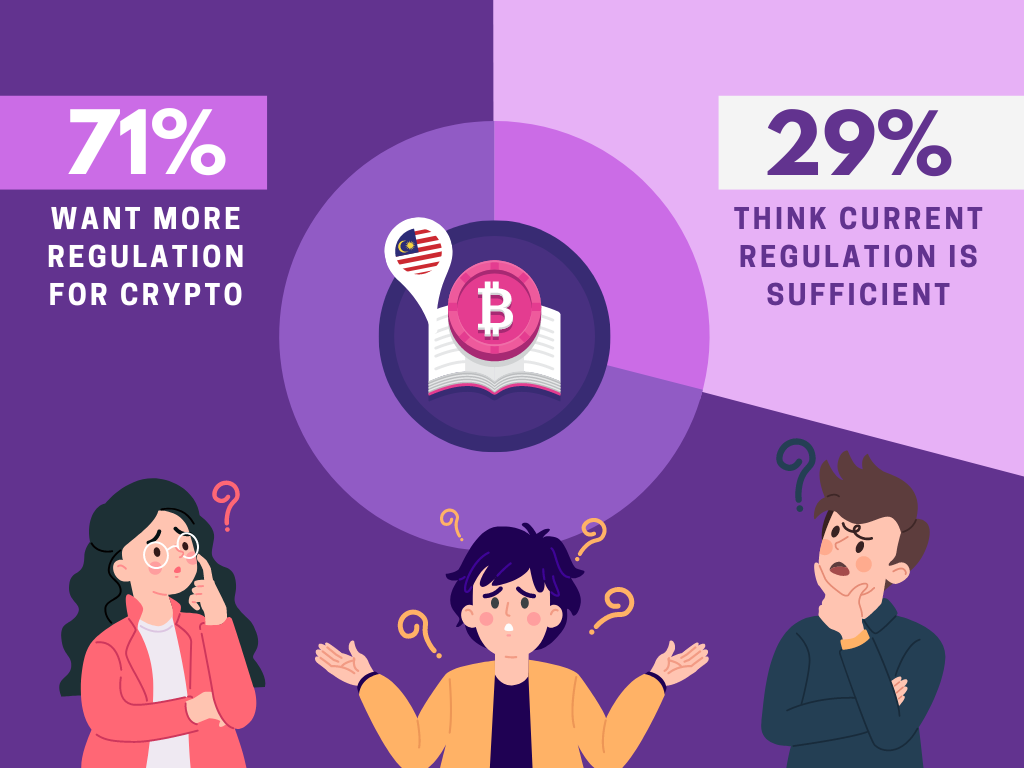

Recent Survey Shows 71% Of Respondents Want Further Regulation For Crypto In Malaysia

One of the primary wants among respondents was for more robust regulations.

In collaboration with Luno, we recently ran a survey to gauge what Malaysians think about the current cryptocurrency landscape.

The survey found that 71% of respondents believe crypto in Malaysia needs further regulation.

The majority of respondents agreed that more regulation is needed to further protect retail investors from falling prey to scams and major losses.

However, of all the respondents surveyed, 29% of them believed current regulation is sufficient, and argued that what makes crypto attractive is its decentralised nature.

As of the time of writing, there are four regulated Digital Asset Exchange (DAX) operators in Malaysia, which includes Luno

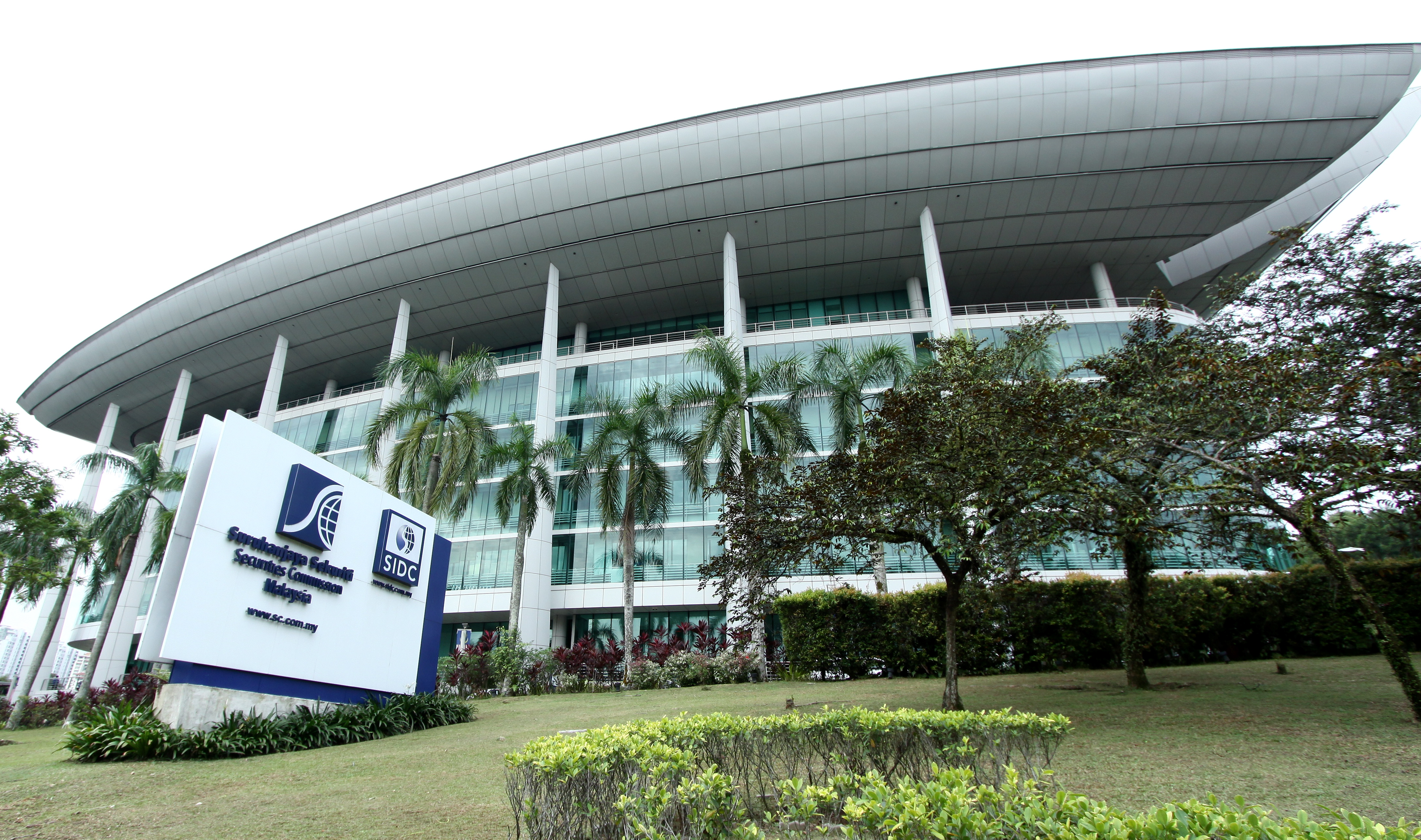

DAXs are digital platforms that allow investors to invest in digital assets. In Malaysia, regulated and approved DAXs are under the purview of the Securities Commission Malaysia (SC) and Bank Negara Malaysia.

But, why is regulatory approval for DAXs important?

According to the SC, the main purpose is to promote responsible innovation in the digital asset space. Approved DAXs have gone through a vigorous application process to get a license that ensures investor protection. In other words, if something goes wrong, investors are able to seek redress with the SC.

However, investors who use unapproved DAXs run the risk of losing it all.

Additionally, some of the biggest concerns were crypto's unpredictable price, general market volatility, and misinformation

One respondent noted that "there is still lots of misinformation about crypto."

Another respondent said more regulation is needed "to protect and educate users from scams and frauds."

The survey also found that Malaysians get their primary source of crypto information from varying sources, including crypto-focused websites (35%), news outlets (29%), and social media communities (16%).

While a majority of respondents (77%) had at least a basic understanding of crypto, they said many investors are still unsure about cryptocurrency and its uncertain profits.

The good news is that regulatory provisions are already in place for approved DAXs in Malaysia, and they provide a safe avenue for people to invest in cryptocurrency.

Here are benefits of using regulated DAXs:

1. You gain better consumer protection and accountability from crypto exchanges

When investing through a regulated DAX, you can invest in crypto within a safe and secure environment. Regulated DAXs like Luno are required to comply with certain standards and industry best practices.

Regulations also allow DAXs to collaborate with regulators to push for the growth and development of the crypto landscape. Besides being accountable to the SC, both parties also work together to grow the crypto landscape.

2. If you're an investor, the SC will safeguard your interests

According to InvestSmart, an initiative by the SC, money invested via regulated DAXs "will be kept in a separate trust account for safekeeping, to ensure that in case something goes wrong with the DAX, your investment is protected".

There have been instances where high-profile but unregulated DAXs have crashed, and in these cases, many investors lost everything they invested. Thankfully, regulated DAXs in Malaysia protect your investments in accordance with the law, which further instils investor confidence.

3. You will be protected from potential scams and frauds

While other platforms may offer flashy promotions, promise to multiply your money, or give you a wider selection of digital assets, be careful with what's being promised!

With all kinds of crypto scams out there these days, one of the safest ways to steer clear of scams is by investing through a regulated DAX. If your transactions only take place within the platform, scammers will have a harder time getting a hold of you or your information.

4. You can invest in cryptocurrencies that have already been vetted

According to a report by The Edge, before any cryptocurrencies are approved for Malaysian investors, DAXs have to conduct appropriate evaluative measures.

In the case of Luno, which carries the widest range of approved cryptocurrencies in Malaysia, they carry out rigorous risk assessment and mitigation processes before listing any new coins to protect customers and provide them with a safe crypto investing experience.

This is especially helpful for new investors, who are also encouraged to do their own research before making any investments.

For crypto investors, it is recommended to avoid unregulated platforms, as they are not subject to the same oversight as regulated platforms

Besides that, as the crypto landscape continues to change, it's important for relevant authorities to be nimble and to review policies regularly to suit the ever-changing technological and market climates, and to ensure that innovation isn't stifled.

To that end, Luno is working closely with the SC to secure investor interests and to advance the development of the local crypto landscape.

All in all, if you're thinking about investing in crypto, download the Luno app on the App Store or Google Play to invest with peace of mind

Wanna learn more about the latest crypto trends and investment tips? Visit Luno Discover, your guide to all things Bitcoin, Ethereum, and more!