This Insurance Helps Protect Your Valuables At Home From Fire, Flood, Theft, And More

Your normal home insurance may only cover the building, not your belongings.

Most homeowners buy home insurance to cover the building they stay in. However, they often overlook the need to cover their personal belongings in their home.

What most people don't realise is that home insurance only covers damage to the home building, including the cost to repair or rebuild the home. For instance, if your home is damaged because of a fire, home insurance may cover the repair costs but not your personal belongings lost in the process.

That's why it's important to get home content insurance on top of your home insurance.

SOMPO Home Content is an insurance plan that protects your belongings against loss or damage by fire, theft, or accidents

1. You can cover your belongings with a low annual premium

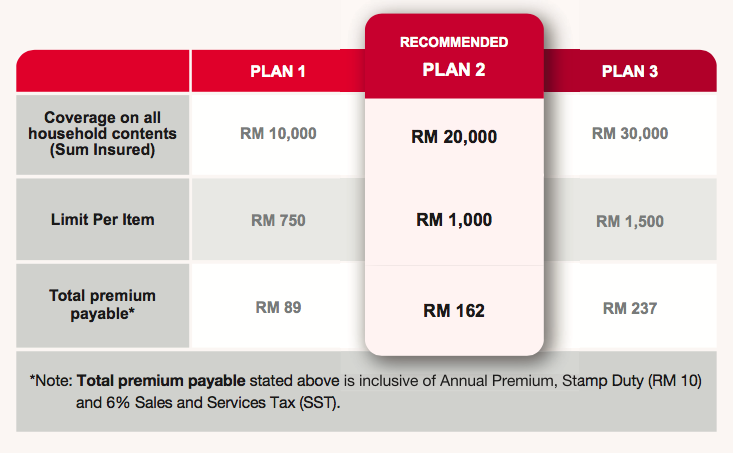

Did you know that your home belongings can add up to a pretty big sum? SOMPO Home Content gives you coverage of up to RM30,000. The great thing is that you can get this home content insurance from just RM89 a year, which is just RM0.24 a day!

2. It's easy to sign up and easy to claim

SOMPO Home Content makes it super easy to buy insurance and claim if anything happens. Before signing up, you don't need to disclose the value of every item in your home. When you claim, you don't even need to show receipts of your belongings that were damaged or lost. All you need is a police report if it's a criminal act.

3. You don't have to worry about penalty for underinsurance

If your insurance policy insures a sum of RM30,000, but you have belongings at home worth RM60,000, you are underinsured.

Usually, if you are underinsured, you will have to pay a penalty. However, with SOMPO Home Content, you won't have to worry about that because they will cover your policy amount without imposing an underinsurance penalty.

4. It perfectly complements your current home insurance

The great thing about SOMPO Home Content is that it goes with your existing home insurance. In the case of a fire, your home insurance will cover the cost of repairs, while SOMPO Home Content will cover the loss and damage of your personal belongings.

5. It includes full theft coverage, as well as lightning strikes and flood

SOMPO Home Content covers most scenarios, including fire, lightning strikes, flood, house break-ins, and other accidents. It also gives you full theft protection, where theft by visitors to your home like contractors or part-time cleaners are also covered.

Ready to protect your home belongings? Get SOMPO Home Content today to enjoy complete peace of mind.

SOMPO Home Content insurance premiums start from RM89 a year and provide coverage of up to RM30,000. Find out more about their home content insurance on their website today.