A Risky Gig: Majority Of M'sian E-Hailing & Delivery Drivers Have No Insurance Or Savings

Once a side job, the gig work has now become a major source of income. But a significant majority of the gig workers have no emergency or retirement/old age savings.

Gig platforms or app-based services that once used to be a side hustle for many Malaysians have now become a major source of income for close to 250,000 gig workers around the country, according to a study

Published by The Centre, a research organisation dedicated to centrist views in the Malaysian context, the study is an in-depth survey of over 400 e-hailing and delivery drivers from around the country.

In the study, The Centre surveyed a total of 464 e-hailing and delivery drivers, a major segment of gig workers in Malaysia. Out of 464, they removed 53 responses that did not meet the sampling criteria.

"Gig work is no longer primarily a side hustle for extra income," The Centre said, adding that, "Over half of survey respondents perceived gig-work to be their primary source of income or their main job."

"We categorise 58% of respondents as effectively working 'full-time', 19% working 'part-time', and 23% working as 'casual' gig workers," The Centre said in the study's key findings, emailed to SAYS.

"Gig work" by definition is temporary work.

Wikipedia describes that gig workers are either "independent contractors, online platform workers, contract firm workers, on-call workers" and/or temporary workers.

A gig worker is basically one who enters into formal agreements with on-demand companies, for example, Grab, MyCar, etc, to provide services to the company's clients. Gig workers are not employees.

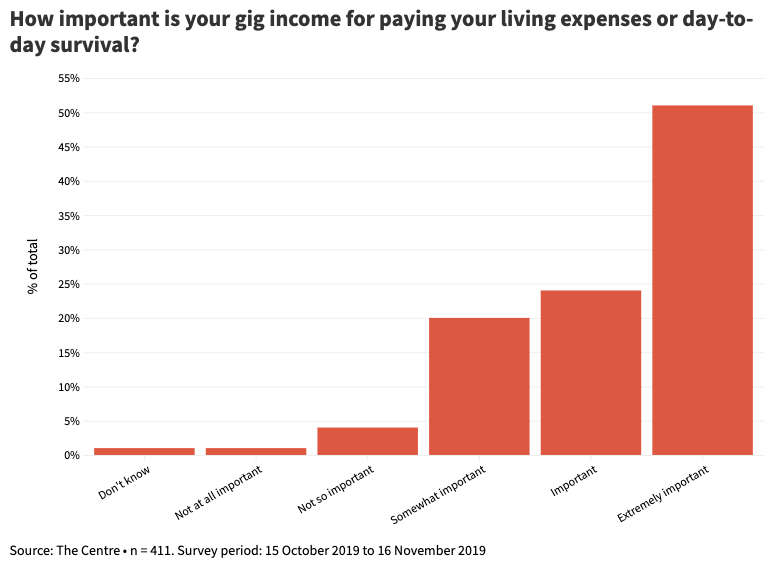

The study also stated that whether the primary or supplementary source of income, 75% of those surveyed said that gig income is an 'important' (24%) or an 'extremely important (51%) source of income

Additionally, the study said that the importance of gig income cuts across the board, refuting the perception of gig work as casual work or side hustle for pocket or extra money.

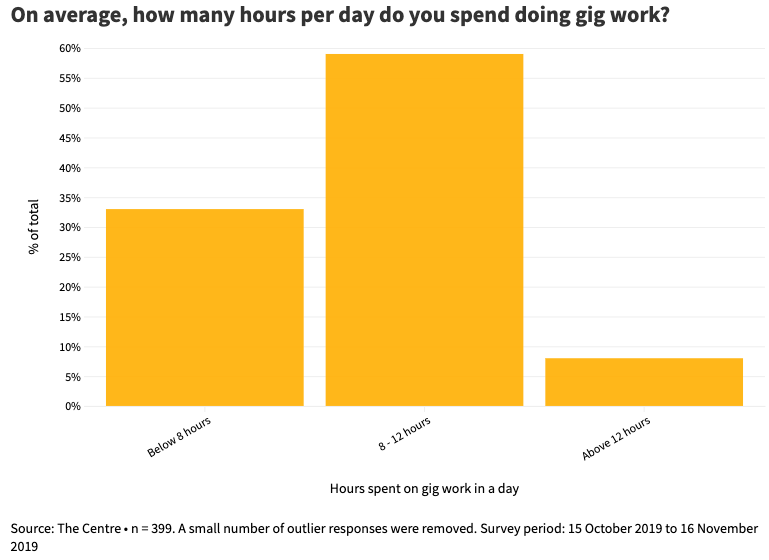

In terms of hours and the number of days spent on gig work, the study showed that for the majority of them, both resembled a full-time job

"The number of days spent on gig work also resembles full-time employment," the study said.

"If the Employment Act 1955 definition for 'full-time' work (not more than 48 hours per week) and 'part-time' work (30-70% of full-time hours) are applied here, we can infer that 58% of respondents are effectively working 'full-time' and 19% working 'part-time'. We classified the remaining 23% who work less than part-time hours week as 'casual' workers."

A lifeline for those without degrees

"Based on our survey responses however, gig work appears to be a lifeline primarily for those without degrees. Only 16% of 'full-time' gig workers have a Bachelor's degree or higher; the remaining 84% of 'full-time' gig workers do not possess a university degree," it said.

According to the study, gig workers are here to stay as more than two-thirds of gig workers surveyed said that they intend to continue their gig work for another year or more.

"Gig work has become a new main job and main income option, particularly for those without tertiary education," according to the survey's key findings.

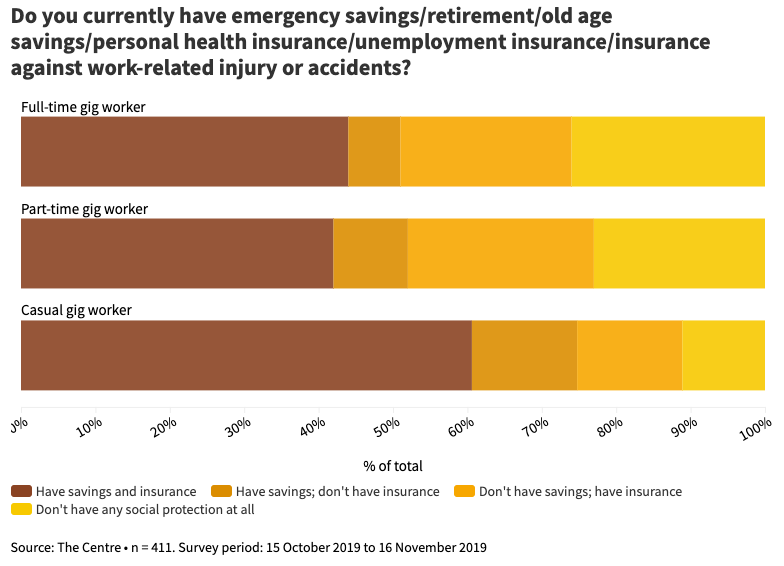

However, while gig work has become a new main job and main income option for many, a significant majority of the gig workers in Malaysia have no emergency or retirement/old age savings, the study found

"Gig workers lack access to social protection such as Employees Provident Fund (EPF) contributions, which are mandated by law only for formal employees. In the gig economy, gig workers are deemed as freelancing 'partners' rather than employees," the study by The Centre stated.

According to the study, with the rise of gig platforms, the need for gig workers' social protection is growing, though a significant majority of them do not have emergency and retirement/old age savings.

"Very importantly, 22% or close to one-fifth of those surveyed do not have any of the mentioned forms of social protection," according to the study published last week.

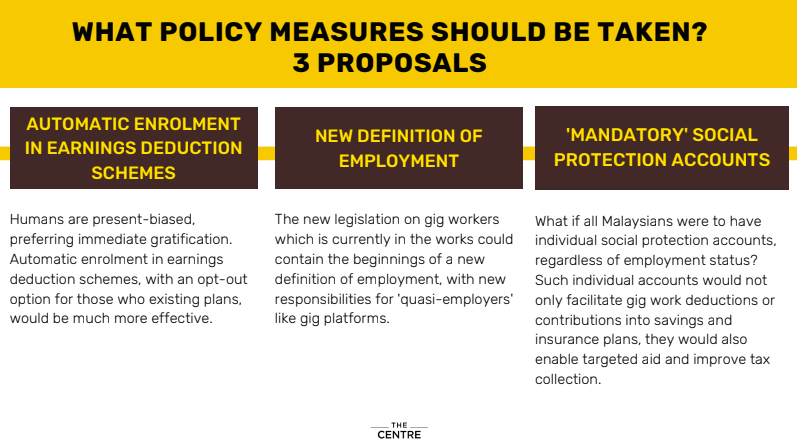

Considering the fact that a significant proportion of gig workers are effectively behaving and contributing as full-time workers, the study asks, "What kind of social protection schemes should be in place?"

In the summary of the survey's key findings, the study stated that:

- Gig workers are willing to contribute financially towards their social protection benefits.

- More than two-thirds of surveyed gig workers would allow gig platforms to deduct from their gig income to go towards social protection benefits.

- At the same time, a whopping 92% of gig workers in this study feel that gig platforms should also contribute to gig workers' social protection, particularly 'full-time' gig workers.

Meanwhile, when asked how much are gig workers willing to have deducted or set aside, 64% of gig workers surveyed said they are willing to have under RM200 a month put aside for the various savings and insurance benefits that were outlined in the study.

"Today, social protection for gig workers is mainly on a voluntary basis, such as voluntary retirement savings scheme i-Saraan; the only mandatory form of social protection is work-related injury and accident insurance for e-hailing drivers, in line with PSV license requirements," it stated.

"To uphold the principle of fairness and to avoid labour exploitation, we believe that gig workers who consistently put in full-time hours every week (or more) should receive social protection contributions from their gig platforms," the study states in its point about policy considerations.

"Implementing matching contributions by gig platforms is a trickier proposition as who is effectively working 'full-time' hours at their gig job changes all the time. But it is not impossible."

To avoid labour exploitation, the study advocates that gig platforms should contribute towards their worker-partners' social protection

The Centre emphasised that those who employ gig workers "should have fair and clear responsibilities towards workers' welfare, reflecting their labour contribution".

"The Centre hopes for a long-term approach that recognises the changing nature of employment in Malaysia and that fairly assigns responsibilities on both gig platforms and gig workers in the matter of reasonable gig working conditions and social protection," the study said while summarising the survey.

Last year, Prime Minister Tun Dr Mahathir Momahad said that the government is studying to bring in new legislation on gig workers

The new legislation on gig workers could contain the beginnings of a new definition, "one that reflects today's labour market that is increasingly populated by gig workers, contract workers and freelancers".

According to The Centre, "To ensure better social protection, the government plans to include worker protection for gig workers in the drafting of the 12th Malaysia Plan 2021 – 2025."