Here's How You Can Earn High Fixed Deposit Rates With No Lock-In Period With FRANK by OCBC

FRANK by OCBC gives you a new way to save, spend, and manage your money.

One of the easiest ways for you to save and grow your money is through fixed deposits. However, with fixed deposits you usually have to leave a big sum of money in the bank for a long time.

That's money that you can't touch or spend, and if you choose to withdraw your money before it matures, you'll probably lose a big chunk of your interest.

The reality is that most of us don't have a lot of cash just lying around that we can stow away in a fixed deposit account. There are months we need to spend just a bit more, and there are unforeseen expenses we can't always plan for. That's why we're sometimes hesitant to put money into fixed deposits.

To help Malaysians save more while having flexibility, OCBC Bank just launched FRANK by OCBC - a new digital banking initiative

The FRANK Account is not like your everyday savings account. It's a high interest savings account that allows you to split your money between a Save Pot and a Spend Pot, giving you a new way to save, spend, and manage your money.

The best part is that you get to earn interest similar to a fixed deposit rate, with no lock-in period - so you can have the flexibility to withdraw your money whenever you like. With FRANK, it’s all about earning higher interest with no strings attached!

Earn fixed deposit interest rates, while having easy access to cash

Splitting your money between the Spend Pot and the Save Pot makes it easier for you to save up. The idea is that you use the Spend Pot for your day-to-day expenses, while your Save Pot is meant for your savings.

Spend Pot - gives you a base interest rate of 0.3% per annum

Save Pot - gives you an interest rate of 1.8% per annum

However, if you need to take some money from your Save Pot, you can move your money back into your Spend Pot at any time through the OCBC Malaysia Mobile Banking app. What's unique is that there is no lock-in period or withdrawal penalty. It's your money, your rules!

Shop online without the foreign exchange markup

When you shop online, especially for overseas stores, you may realise that the final price when you checkout is higher than when you added it to your cart. It's really annoying!

This happens when you're paying in foreign currencies using a bank card as it incurs an exchange rate markup fee. To avoid all that headache, the FRANK Debit Card offers you 0% Foreign Exchange Markup, so that you can choose to pay in whatever currency you like when you spend with the FRANK Debit Card!

To top it off, you can use the debit card to make contactless payment at over 400,000 merchants nationwide, or withdraw at around 14,000 ATMs, anywhere in Malaysia.

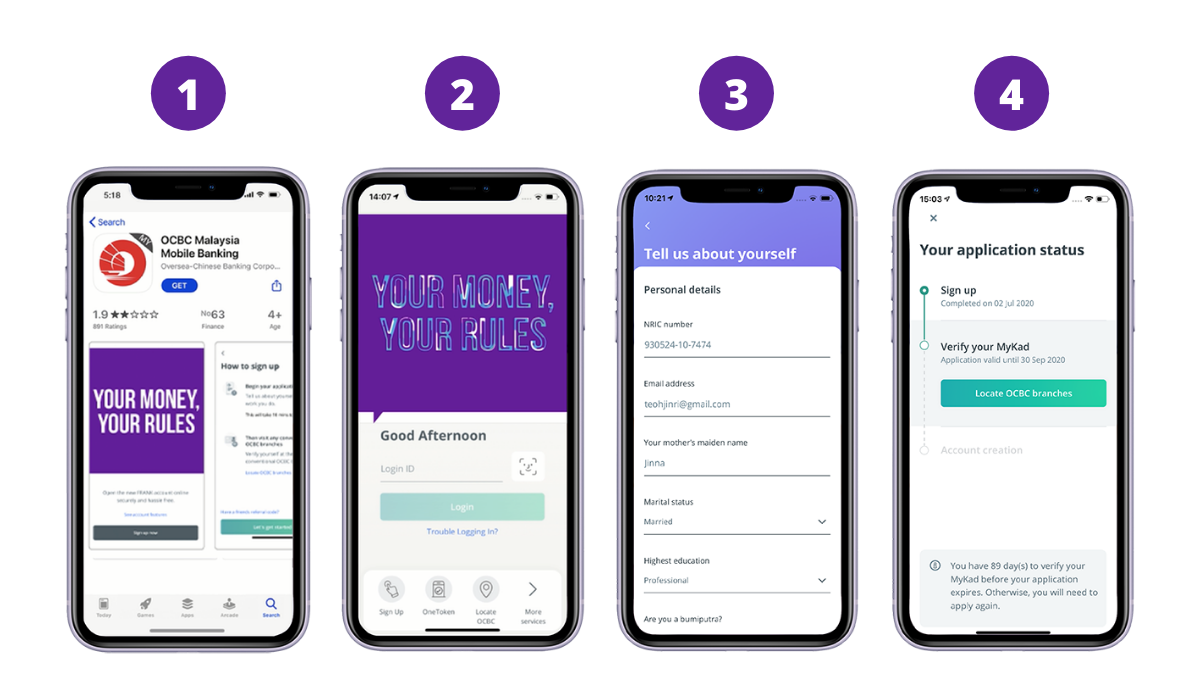

Ultimately, FRANK wants to help you make the most of your finances. You can now apply for an OCBC FRANK Account in four simple steps:

STEP 1: Download the OCBC Malaysia Mobile Banking app

STEP 2: Launch the app and tap ‘SIGN UP NOW’ to sign up for FRANK

STEP 3: Follow the steps to sign up for FRANK

STEP 4: Verify your IC and complete the opening of FRANK at any OCBC conventional branch

Find out more about FRANK by OCBC at their website today!

Member of PIDM.

Protected by PIDM up to RM250,000 for each depositor.