M'sian Fintech Startup Makes Life Easier For The B40 Community, Migrant Workers And More

Their newly launched Joy platform is expected to reach five million users.

Payfo was first introduced in 2018, with a clear purpose in mind—to create lasting social impact in Malaysia through the latest financial technologies available

Local startup Payfo is fully owned by Percetakan Nasional Malaysia Berhad (PNMB), which is in charge of the printing and press work for various government ministries, offices, and agencies. With a history of over 100 years in the printing industry, PNMB has since established itself as the largest printing company in Malaysia.

As PNMB's fintech arm, Payfo aims to work towards disrupting the nation's financial space by providing technological solutions that aid both business-to-business (B2B) and business-to-consumer (B2C) services.

1. Subspays helps state and federal government agencies manage subsidies to the B40 group in Malaysia

Subspays is a semi-autonomous and cashless subsidy platform that helps agencies manage their subsidy provisions.

Together with PNMB's state-of-the-art smart card manufacturing facility, they are able to complement their digital solution with a closed loop smart card solution and an open loop EMV certified solution.

2. Bepasar helps migrant workers remit money back home

To help ease the pain points of migrant workers, Bepasar makes it seamless to remit money back to their home countries. The app also allows them to pay their bills at home and choose preferred products from their home countries via an e-marketplace.

3. Kredids addresses the needs of businesses in supply chain financing

Kredids was initially created to cater for invoice financing and factoring companies. Since then, it has evolved to also include P2P and ECF players, as well as traditional financial institutions to provide companies with quick alternative financing solutions.

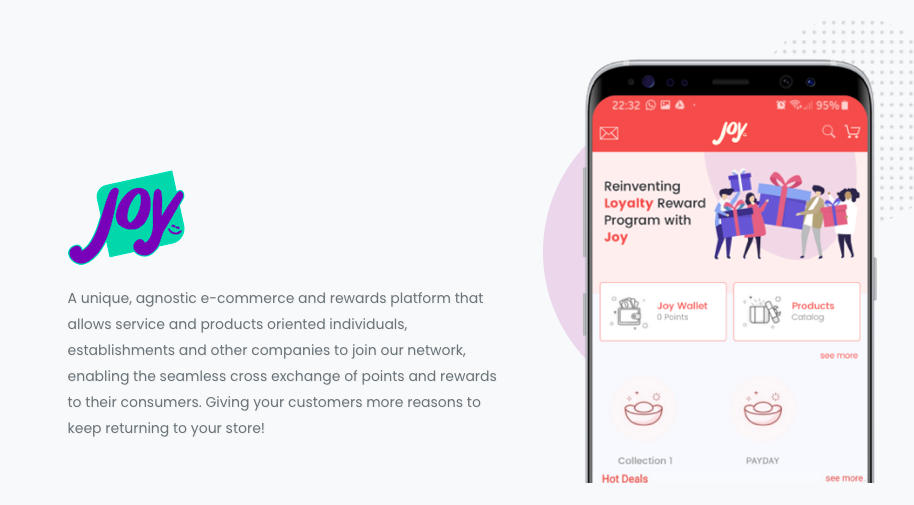

4. The all-new Joy platform acts as an e-wallet and rewards platform

Joy is an all-inclusive omni-channel digital payment, e-commerce and reward platform that aims to benefit both its users and merchants.

This digital loyalty platform will help online and offline merchants to build their customer base and improve their customer retention. Users, on the other hand, get to enjoy the convenience of an e-wallet along with awesome rewards.

Set to be launched in the first quarter of 2021, Joy will first be available as an exclusive platform for the Al-Bukhary Group employees, which has over 200,000 individuals. To date, Joy has already onboarded strong brand partners like MPH Bookstores, Komugi, and Affix AXA.

Through partnerships in the near future, Joy is expected to reach five million users.

Find out more about Payfo and how they are disrupting the financial space in Malaysia on their website