Adulting 101: How To Manage Your Money To Afford Kids, A House, And Retirement

Can we go back to the days when we used to get pocket money? :')

Have you ever heard about wealth management?

It may sound a little serious in the beginning, like something that's meant only for rich people.

In reality, wealth management is just about money management, which is part and parcel of adulting life. Planning how to use your money is not exactly fun, and no one really looks forward to budgeting and figuring out how to make ends meet.

Yet, whichever life stage you're at, money management is important to ensure you can reach (and afford) your life goals, whether it's to buy your first house, plan a wedding, raise a kid, or retire young.

The problem is that many of us have no clue where to start, or how much we need to be setting aside each month.

This is where money management can help, where a professional will guide you on the best way to spend and save.

Anyone can gain from money management.

With money management, you'll be getting advice and assistance from someone who knows the best ways to grow your money. Plus, they will be able to help you chart your potential growth, so you'll know exactly what you need to do now to achieve your future life goals.

In essence, money management is about getting someone to guide you through assessing the allocation of your finances, so you don't have to figure it all out on your own, hehe. ;P

To help Malaysians kickstart their money management journey, OCBC Bank has come up with a #WaitingForWhat campaign

OCBC Bank believes that anyone can start planning for their wealth, and all it takes is three simple approaches — saving, growing, and protecting.

First, it starts with saving up for a safety net to meet your needs and in case of emergencies. Next, it's all about maximising your monetary gains through investments. Lastly, you should consider how to safeguard and protect your loved ones, be it through retirement or protection plans.

If you don't know where to start, OCBC Bank's wealth managers will guide you every step of the way.

Another cool thing they have introduced is the OCBC Life Goals Calculator that helps you gauge how much you should save or invest to prepare for your children's education or retirement

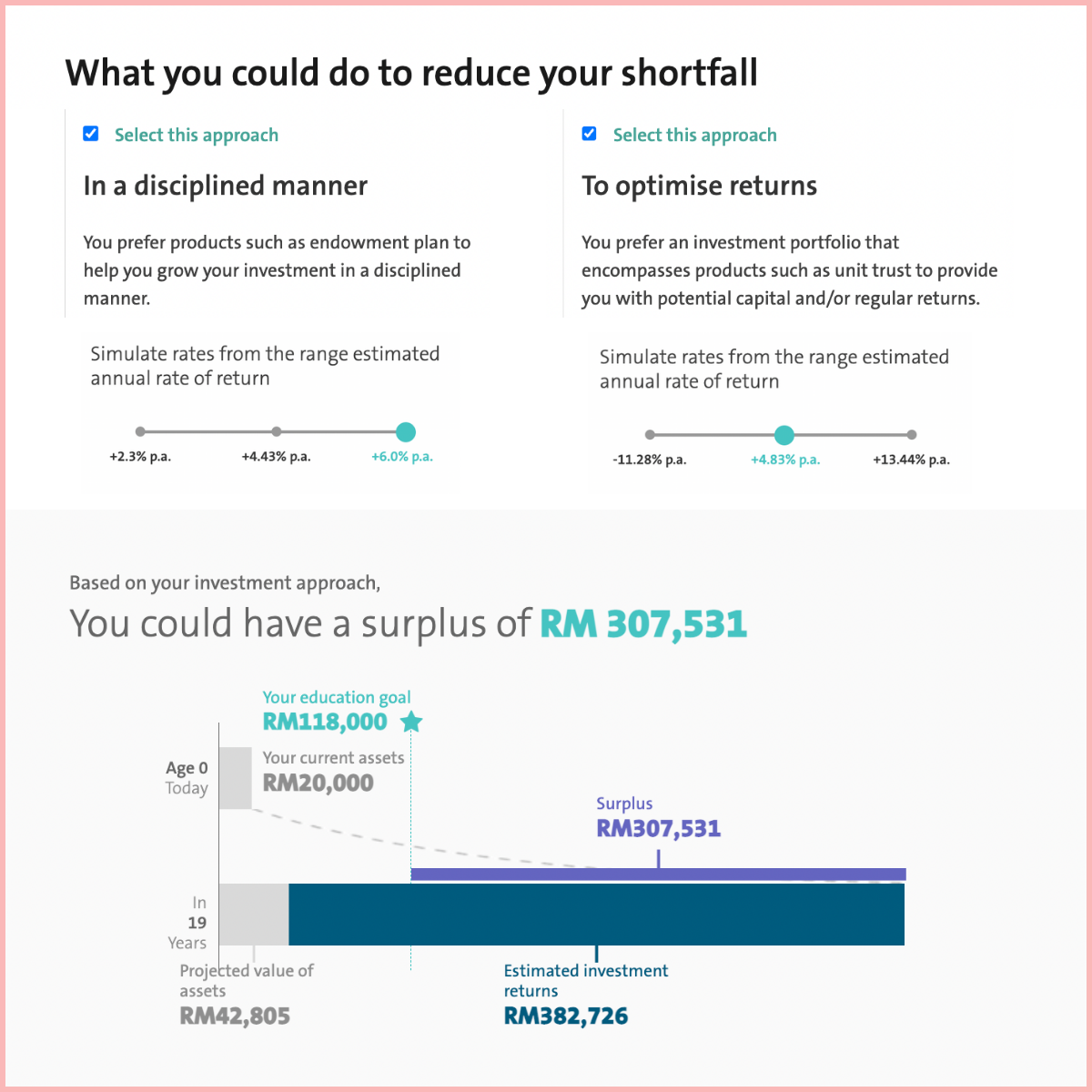

For instance, if you want to plan for your child's future education, the Child Education Goal Calculator can project the cost of future education.

Then, you can see what you currently have versus what you need to do to reach or exceed your goals, whether it's through monthly savings or investments. You can also choose from various risk appetites and investment amounts to compare the results.

Using the Child Education Goal Calculator, you'll get a rough idea of how to manage your wealth.

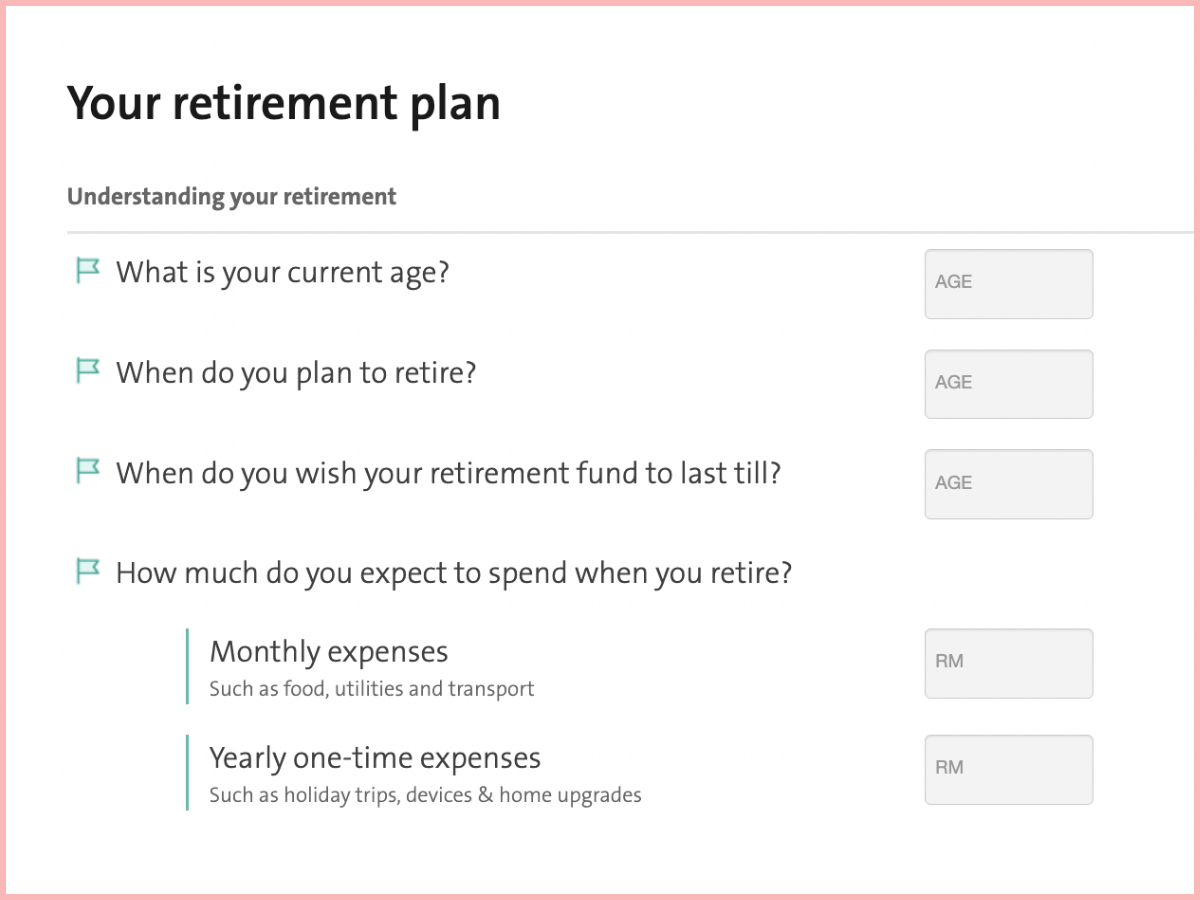

Besides that, there is also the Retirement Goal Calculator to help you plan and save for your retirement

Regardless of your life stage and how much you currently have, you can always make an appointment with one of OCBC Bank's Personal Financial Consultants to learn more or start your financial journey.

Ultimately, OCBC Bank wants Malaysians to know there's no better time to grow your money than right now.

You #WaitingForWhat? Head over to their website to learn more today!