Grab To Charge 1% Credit Card Reload Fee Starting 11 September

You can still top up for free with your debit card or bank transfer.

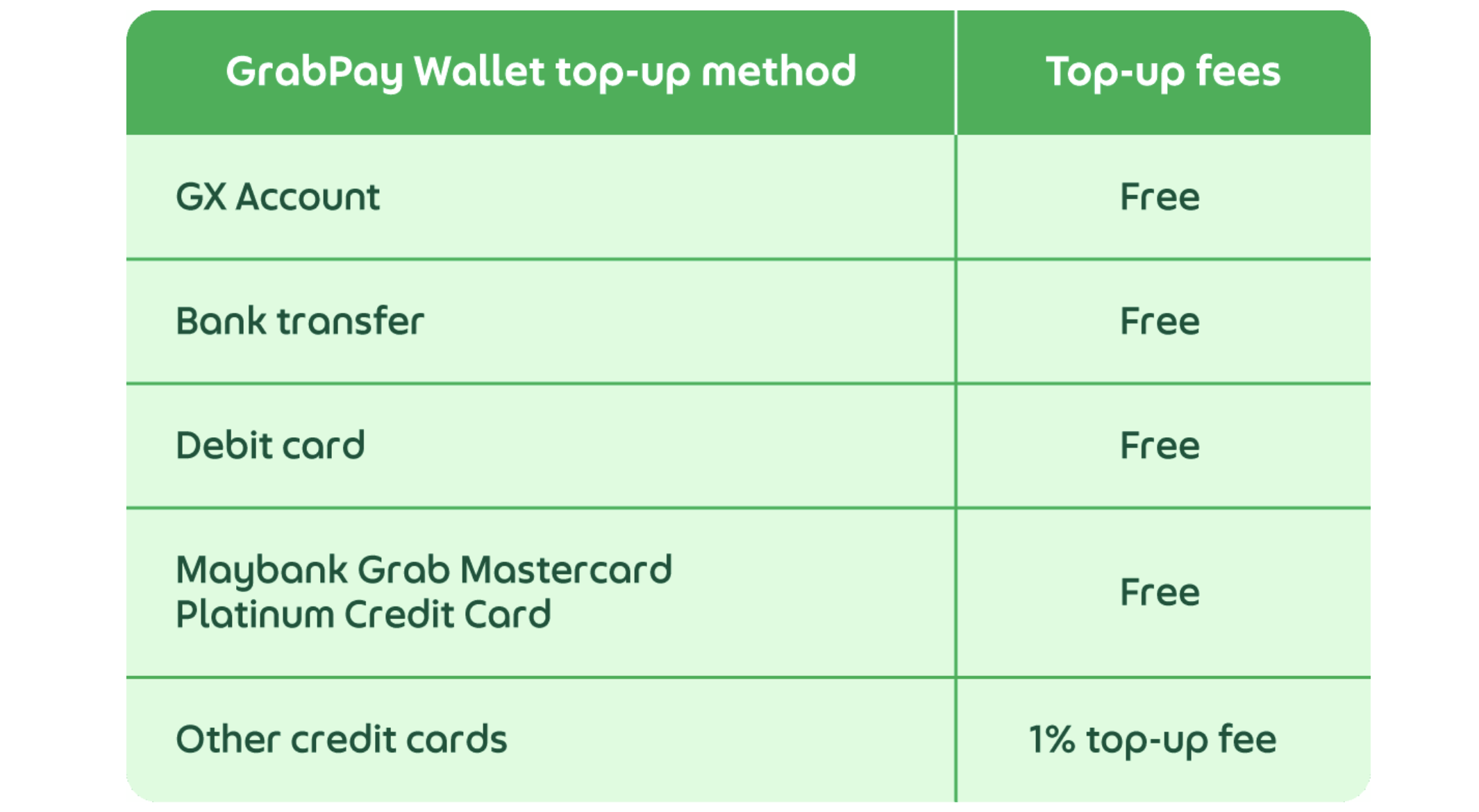

Starting 11 September, Grab Malaysia will impose a 1% fee for most credit card reloads to your GrabPay Wallet

However, if you use Grab's co-branded Maybank Mastercard, you can avoid this fee, as the new charge will not apply.

There are other ways to bypass this fee as well. According to the company's website, you can top up your GrabPay Wallet via debit card or bank transfer without incurring any extra charges.

Similarly, Touch 'n Go announced earlier this year that a 1% fee will be applied to all credit card reloads

To reload your Touch 'n Go eWallet for free, you can use bank transfers via DuitNow or debit cards.

Touch 'n Go explained that the 1% credit card reload fee is due to heavy cost of credit card reloads it had been subsidising and excessive credit card balance cashouts.

Grab, on the other hand, mentioned that credit card transactions typically incur processing fees and additional costs for foreign transactions. By introducing the 1% fee, Grab aims to reduce these associated costs, reported The Star.

If you want to continue topping up your GrabPay Wallet for free, there's still time to switch your reloading method

Simply go to the Top Up settings on the Grab app and replace your credit card with a debit card, or remember to use a bank transfer whenever you top up.

Touch 'n Go also previously announced that there is a 1% conversion fee for all overseas QR transactions: