Only 1 In 2 Home Loans Are Approved In Malaysia. Can You Afford A House? Find Out Here

It only takes 5 minutes!

Only 1 in 2 home loans are approved in Malaysia. That's why PropertyGuru wants to help you make confident property decisions that allow you to find the best home for your lifestyle.

Under the Own Your Home Programme, PropertyGuru is empowering 100,000 Malaysians to become homeowners by 2020.

One of the many initiatives by PropertyGuru to achieve this is the PropertyGuru Loan Pre-Approval - a 5-minute tool to show you whether you can afford to buy your dream home

PropertyGuru Loan Pre-Approval is the only bank-preferred loan solution that allows you to be sure of how much home loan you can get from the bank.

Why is it important to get Pre-Approved?

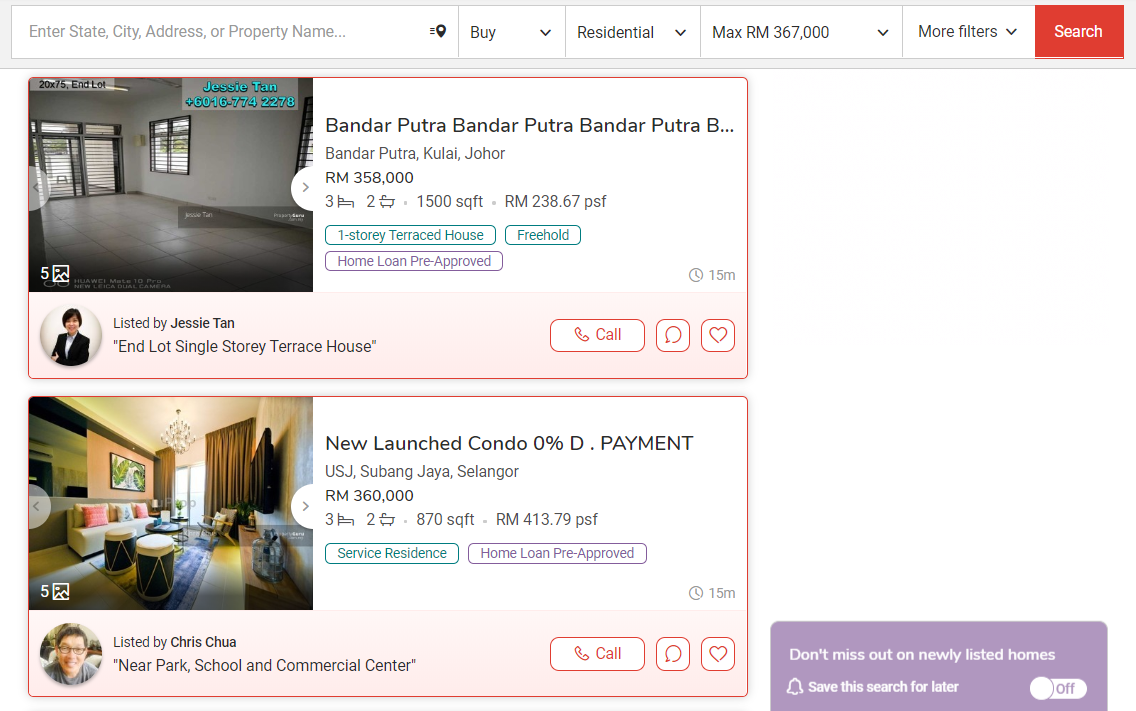

- The tool accurately calculates how much the bank can lend you, so you know the price range of properties to focus on.

- Search for a house based on your eligible loan amount. It will be more precise and so much easier than ever before!

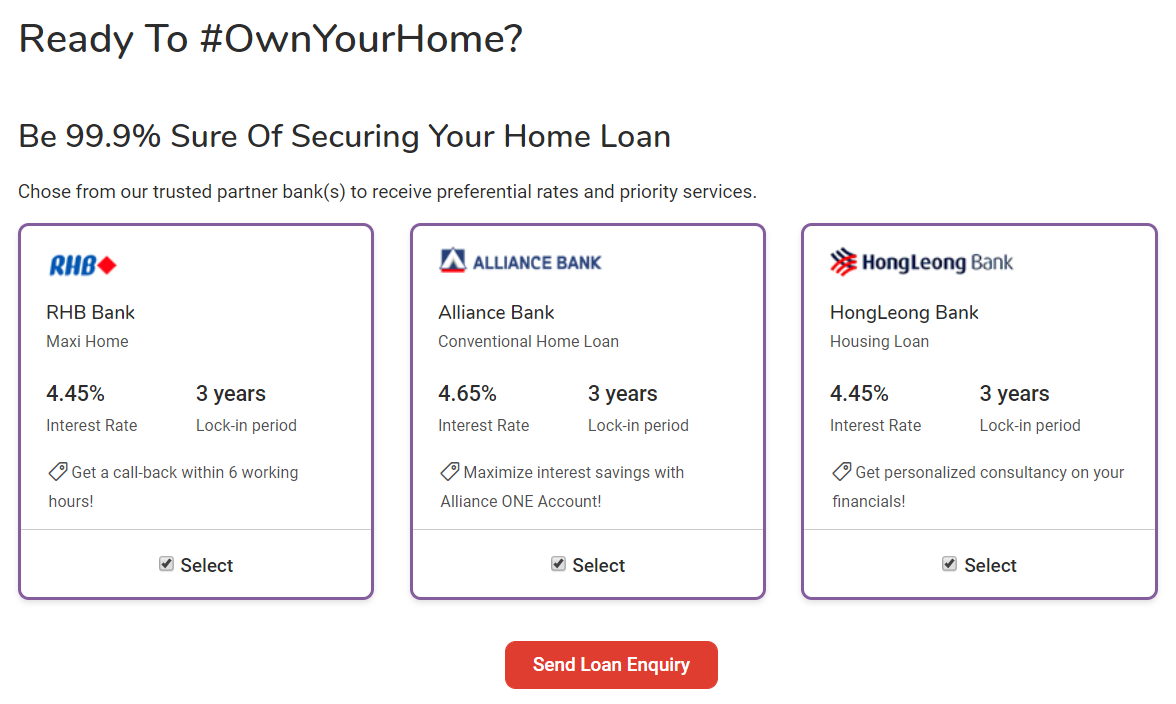

- Submit your Pre-Approved property to our bank partners, and get better interest rates for your loan. You also get to save more.

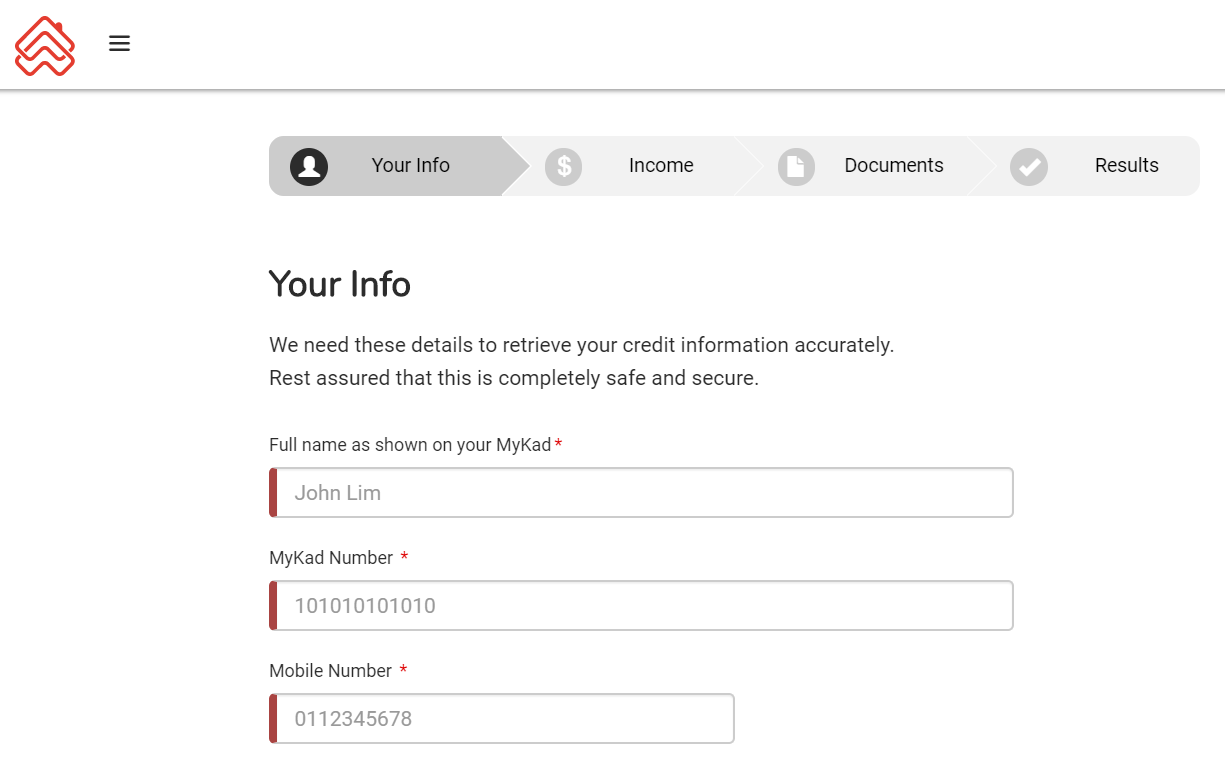

1. Enter your basic info including your name, MyKad number, and mobile number

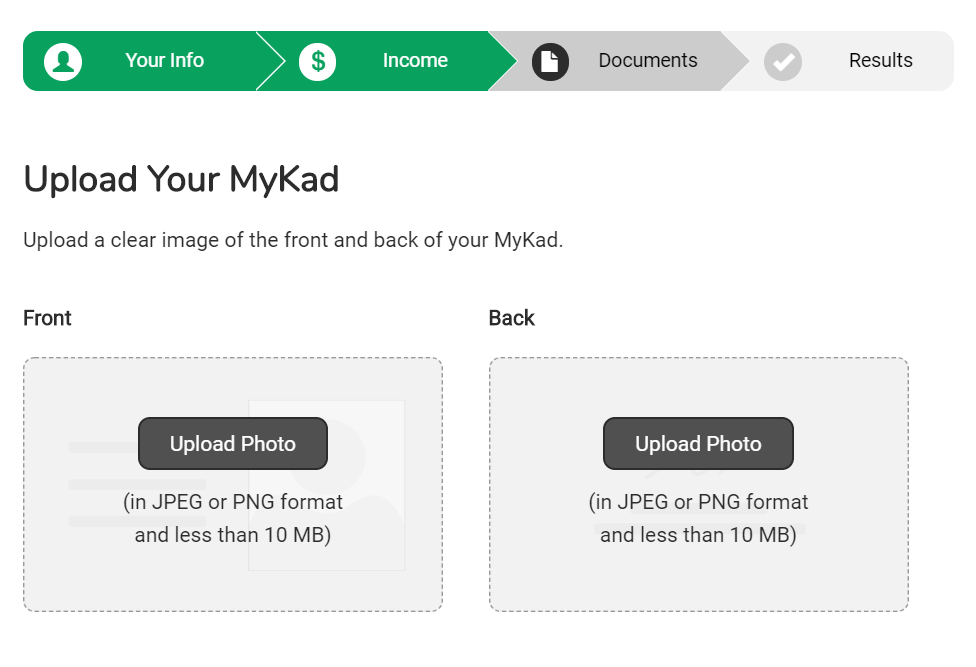

3. Upload the front and back of your MyKad for verification purposes

Your information will be verified (it only takes a few seconds!) so that you can get an accurate DSR and ‘eligible loan amount.’

Unlike other DSR/loan calculators, PropertyGuru provides the most accurate indication of how much banks will lend you. This is because PropertyGuru provides secure access to your credit information.

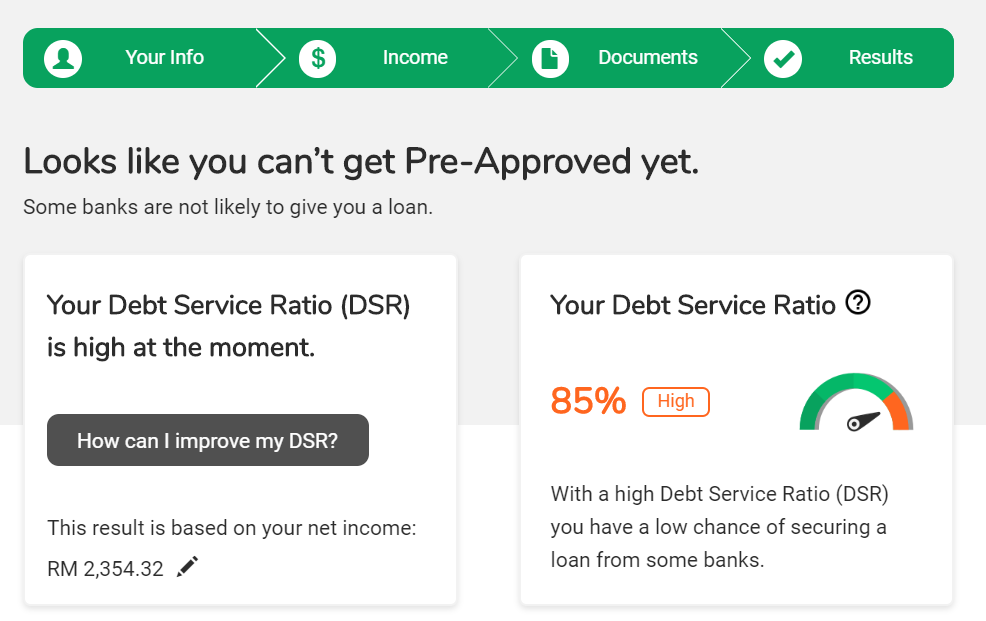

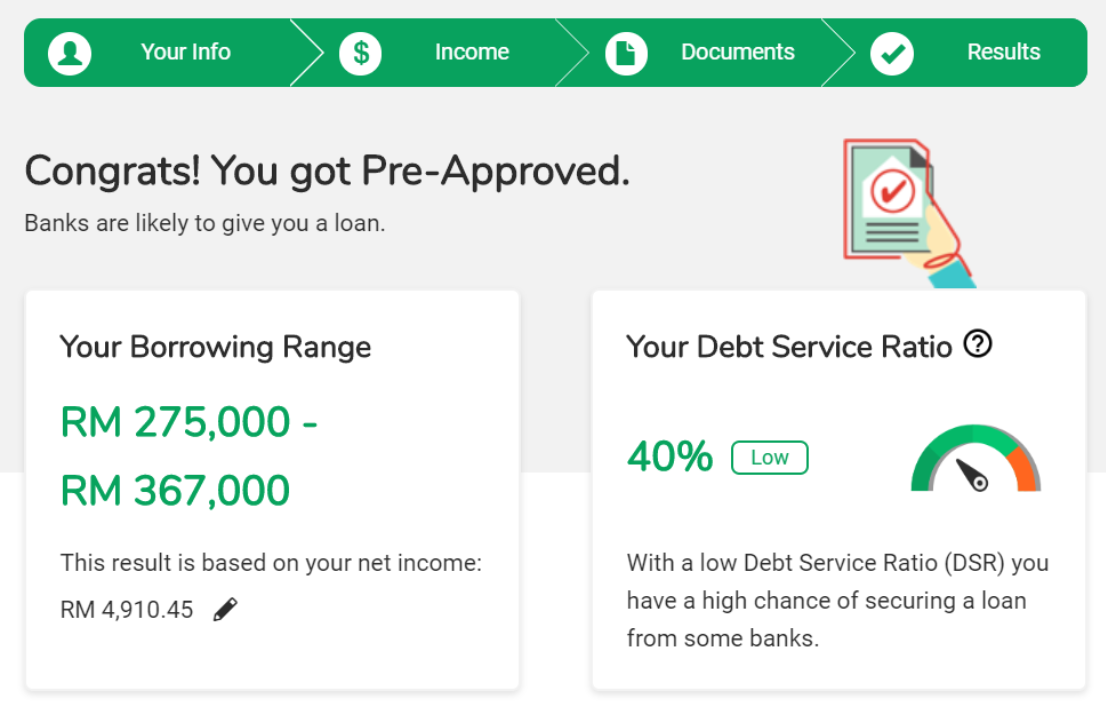

4. There are two possible results for your 'eligible loan amount' depending on your Debt Service Ratio (DSR)

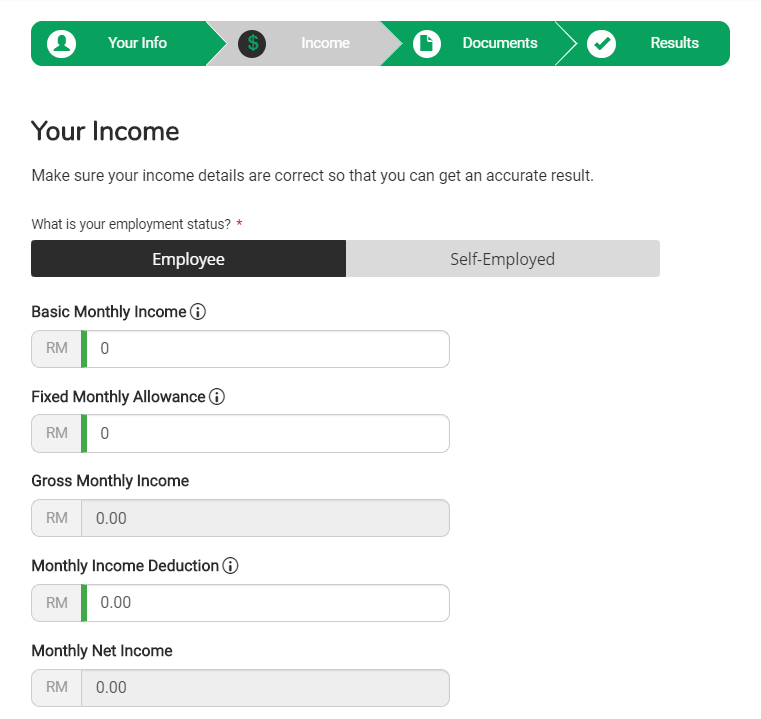

The DSR percentage determines the maximum amount that can be borrowed, which is your eligible loan amount. Keep in mind that this is a general indication based on how much your self-declared monthly income is.

If your DSR is high, you may not get Pre-Approved yet. But don't worry, your journey to owning a home doesn't end there!

Just click on the 'How can I improve my DSR?' button to get advice on how to secure a bank loan.

If your DSR is low, this means you are more likely to secure a bank loan.

Your borrowing range will depend on your net income. It's a great way to start searching for properties because now you have specific numbers in mind!