4 Ways To Manage Your Finances Flexibly And Earn Cashback With The Beyond Card

PayLater at over 100 million Mastercard merchants worldwide and earn cashback rewards!

Are you always on the lookout for ways to make the most bang for your buck during sales, while maintaining your monthly budget?

If so, you're not alone, hehe! As Malaysians, we are always striving to manage our money efficiently and make it stretch until the next payday.

However, it can be challenging to strike that balance sometimes. That's why adopting smart spending habits, such as earning cashback and utilising flexible payment options, can make a significant difference in managing your finances.

If you want a bit of flexibility in your finances and to get rewarded while you're at it, Boost has introduced the Beyond Card, a global prepaid card with a PayLater feature

The Beyond Card is a first-of-its-kind card launched by Boost in Malaysia, in partnership with CelcomDigi and Mastercard. What makes this card stand out is that it's ideal for those seeking credit card alternatives.

What's amazing about the Beyond Card is that you can combine the convenience of prepaid cards (pay-now transactions) and the flexibility of PayLater solutions too. This gives you a range of benefits designed to enhance your shopping experience, all while promoting responsible financing.

1. This Shariah-compliant PayLater solution is accepted by over 100 million Mastercard merchants worldwide

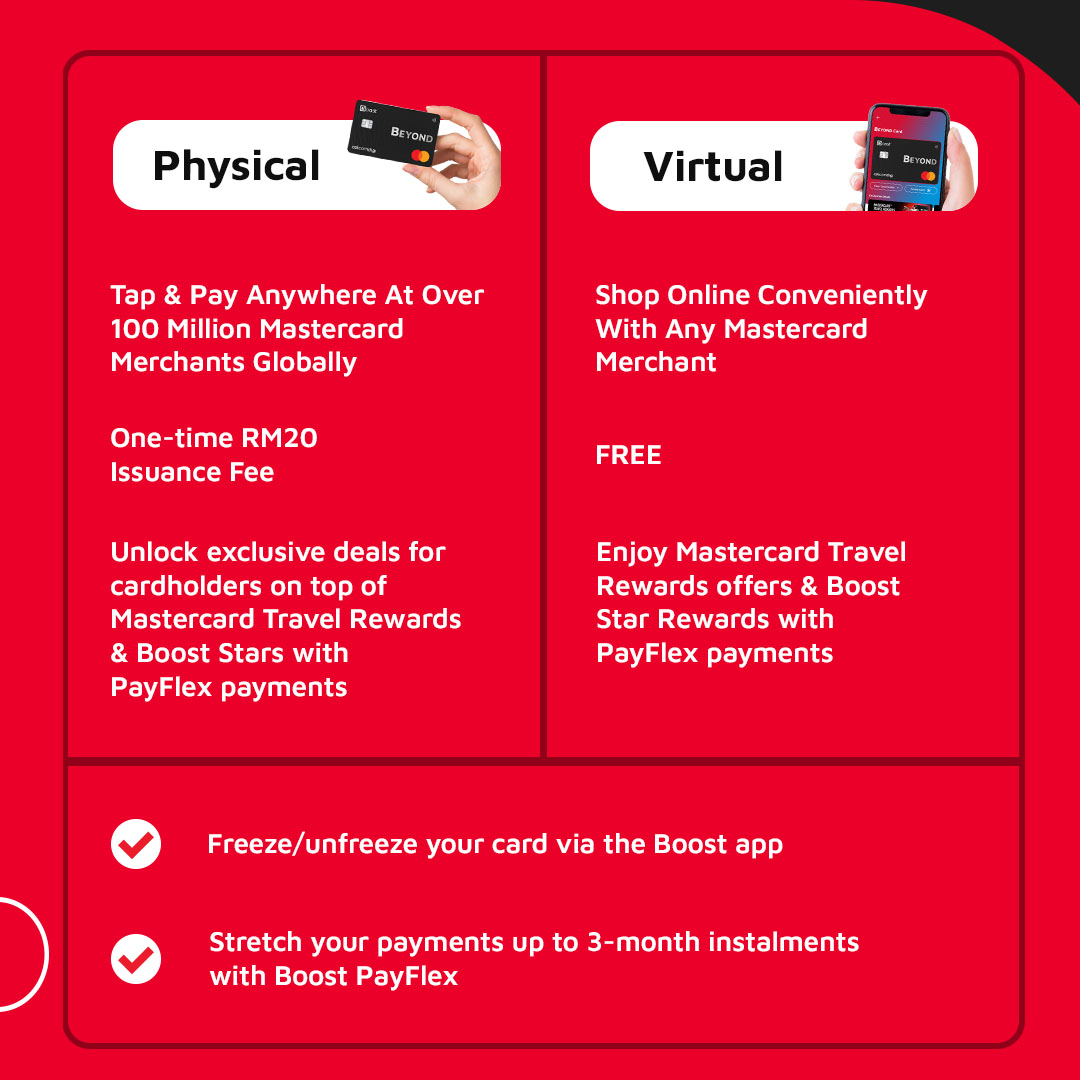

The Beyond Card provides you with two convenient payment options — direct debit (pay-now) through the Boost app's eWallet balance or via its built-in PayLater solution, known as Boost PayFlex™. With Boost PayFlex, the card's integrated PayLater feature, you can extend payments by up to three months (with the six-month option coming soon).

The Beyond Card is also one of the most comprehensive and wide-reaching PayLater options in the market. Accepted by over 100 million Mastercard merchants worldwide for both online and in-store transactions, this card allows you to consolidate all your expenses onto one platform, all on the Boost app.

This makes it easier to keep track and monitor your payment schedules efficiently, especially PayLater transactions, not requiring multiple service providers for specific merchants.

Besides that, as a responsible and regulated fintech leader, Boost employs robust scoring techniques to offer a controlled and personalised credit line based on each Beyond Card user’s affordability assessments to safeguard customers from an excessive debt burden. Additionally, all fees are transparently disclosed upfront for users to make informed decisions.

2. Enjoy exclusive cashback and premium rewards when you shop, both locally and overseas

The Beyond Card offers one of the most premium reward experiences in the market as it is the first card in Malaysia and Southeast Asia to offer Mastercard Travel Rewards. This exclusive rewards programme provides a diverse range of deals spanning travel, shopping, culinary, entertainment, arts, culture, sports, wellness, and more from local and international brands.

Here's a look at some of the deals you can enjoy:

- Up to 11.05% cashback on Shopee

- 6% cashback on Zalora

- 10.5% cashback for purchases at Nike Malaysia

- 6% cashback for online shopping at Adidas Malaysia

- 12% cashback for Lululemon Malaysia customers

- 9.5% cashback on online purchases at Calvin Klein Malaysia

- 7% cashback for CHARLES & KEITH Malaysia shoppers

- 6% cashback at Swarovski Malaysia

- 1,000,000 rupiah (RM300) cashback at Grand Hyatt Bali

- 1,000 baht (RM131) cashback at JW Marriott Hotel Bangkok

Check out the full list of rewards here.

Plus, with every ringgit you spend using Boost PayFlex on the Beyond Card, you'll earn up to three Boost Stars, which can be redeemed for even more savings on the BoostUP Rewards catalogue and for 'Pay With Stars' direct discounts on bill payments.

Additionally, users that successfully apply and opt in for the physical Beyond Card from now until 30 June 2024 will earn a free Inside Scoop ice-cream (one scoop), in the form of a Partner Wallet voucher on the Boost app (first-come-first-served basis).

To maximise your savings, you can consider using the Beyond Card during festive sale periods — combine its benefits with other offers to enjoy significant discounts plus flexible payment options. It's a win-win for you!

3. When it comes to security, the Beyond Card has got you covered

You'll have peace of mind knowing that each of your transactions is password-protected, which ensures an added layer of security. In this case of theft or suspicious activity, you'll also get to instantly freeze your card via the Boost app without having to go through any hotlines.

4. The best part is applying for the Beyond Card is hassle-free with the Boost app

All you'll have to do is follow these simple steps below:

STEP 1: Make sure you download the Boost App, either on Google Play or the App Store.

STEP 2: Create a Premium Wallet at no extra cost upon completion of a straightforward e-KYC registration.

STEP 3: Go to the app's homepage and click on the 'Beyond Card' icon.

STEP 4: Fill in the necessary details and submit your application.

Upon completing the application, you will be issued a virtual Beyond Card instantly once approved. As for the physical Beyond Card (for in-store transactions), you can request it via the app and it will be delivered to you within five to seven working days (there will be a one-time RM20 issuance fee).

The card is currently exclusively available for CelcomDigi users only. However, if you’re not a CelcomDigi user, you can still apply for Boost PayFlex to enjoy flexible payments on the Boost app.

While the Beyond Card is exclusive to CelcomDigi users, all Malaysians can make use of Boost PayFlex on the Boost app.

Eager to get your hands on the Beyond Card? Apply for it here.

You can also learn everything you need to know about Boost PayFlex on their website.