New Khazanah Report Says 90% EPF Members Under 30 Won't Even Have Basic RM240K To Retire

The report paints a bleak picture of the future for many Malaysians.

A new report by the Khazanah Research Institute has raised alarming concerns about the retirement savings of young Malaysians

According to the report, 'The State of Households 2024: Households and the Pandemic 2019-2022', published today, 26 September, over 90% of Employees Provident Fund (EPF) members under the age of 30 will not have enough savings to meet even the basic retirement target of RM240,000 by the age of 55.

The basic retirement savings target numbers are based on estimates by EPF.

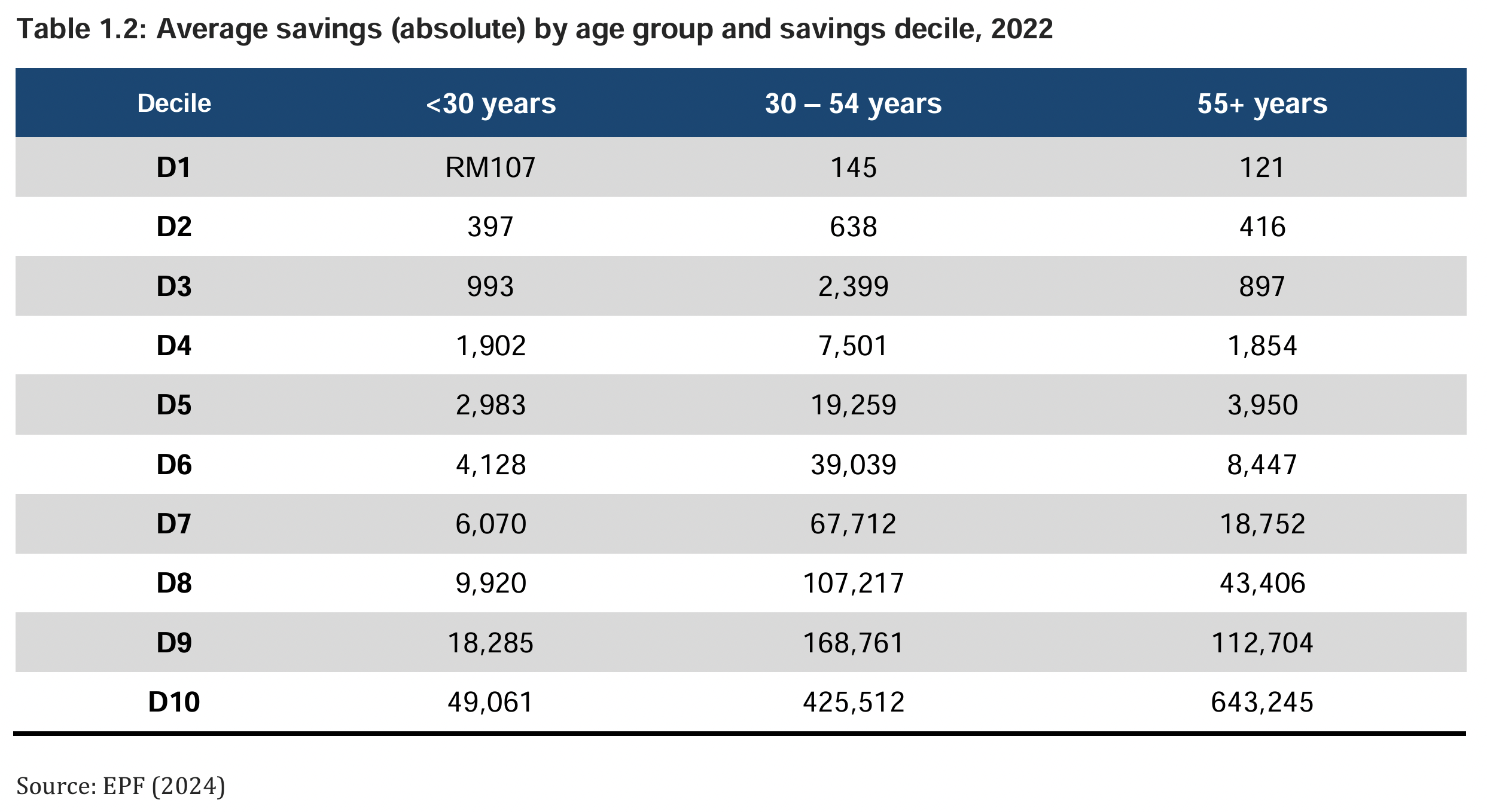

However, Khazanah's analysis of EPF contributions between 2019 and 2022 shows that only the top 10% of contributors under 30 have managed to surpass this basic savings threshold.

The majority of members in this age group fall significantly short, highlighting the structural issue of low starting salaries and financial instability faced by young Malaysians entering the workforce.

The inability of most young Malaysians to reach RM35,000 in savings by the age of 30, underscored by the report, is a reflection of broader economic challenges, such as stagnant wages and job mismatches

While career progression could potentially improve their financial standing, the compounding effect of low initial salaries often results in slower wage growth over time, the report noted.

For members aged 30 to 54, the situation remains grim as well. They are expected to have RM240,000 by the time they reach retirement age, but only those in the top 10% have managed to meet this requirement — with an average person achieving RM425,512 in their savings by the age of 54.

The report notes that many within this group have made withdrawals from their EPF 'Account 2' for purposes like further education and first-home purchases, further diminishing their retirement savings.

Khazanah's report suggests that the current basic savings target of RM240,000, which has not been revised since 2019, may no longer be sufficient, especially as Malaysians' life expectancy continues to rise

According to the report, the target assumes a monthly expenditure of RM1,000 over 20 years, a figure that may need to be reassessed to reflect the increasing cost of living and healthcare needs.

It also calls for greater attention to those working in the informal sector, who are not mandated to contribute to the EPF and, consequently, have little to no safety net for retirement.

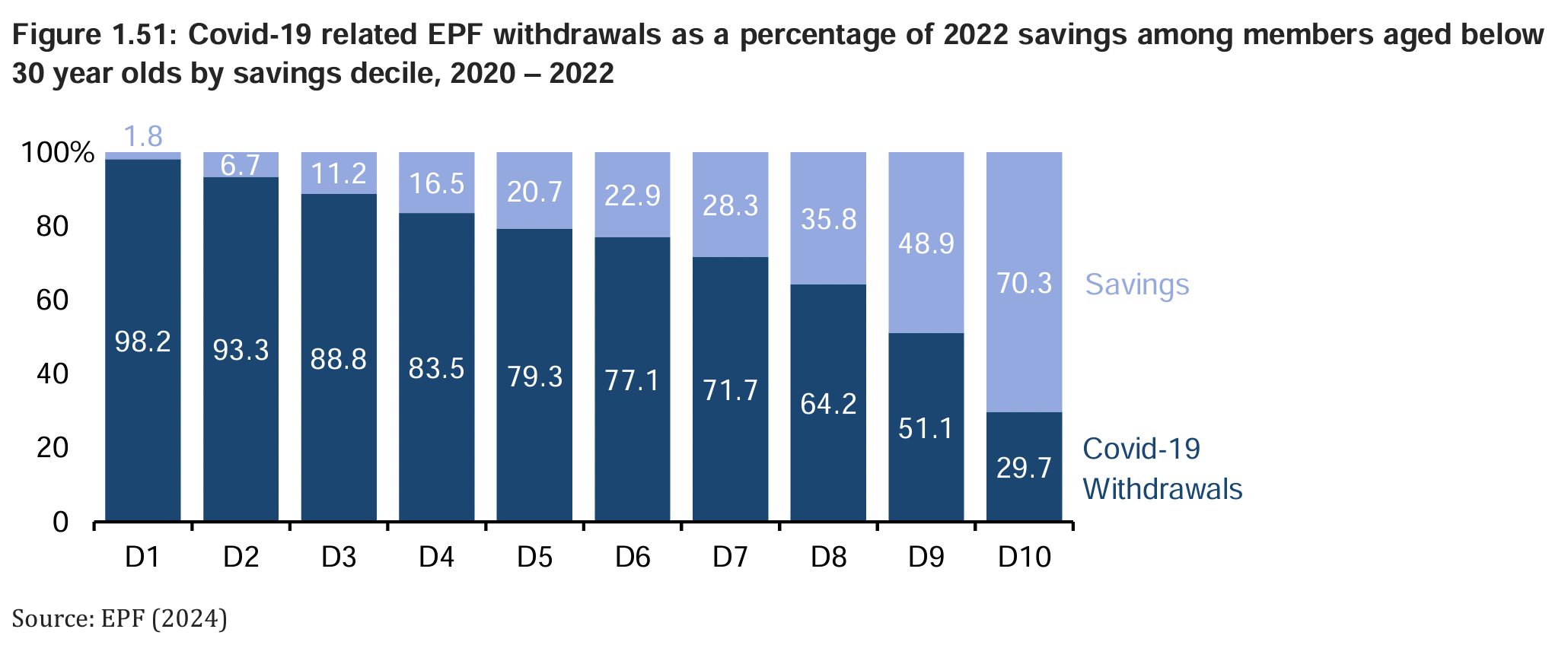

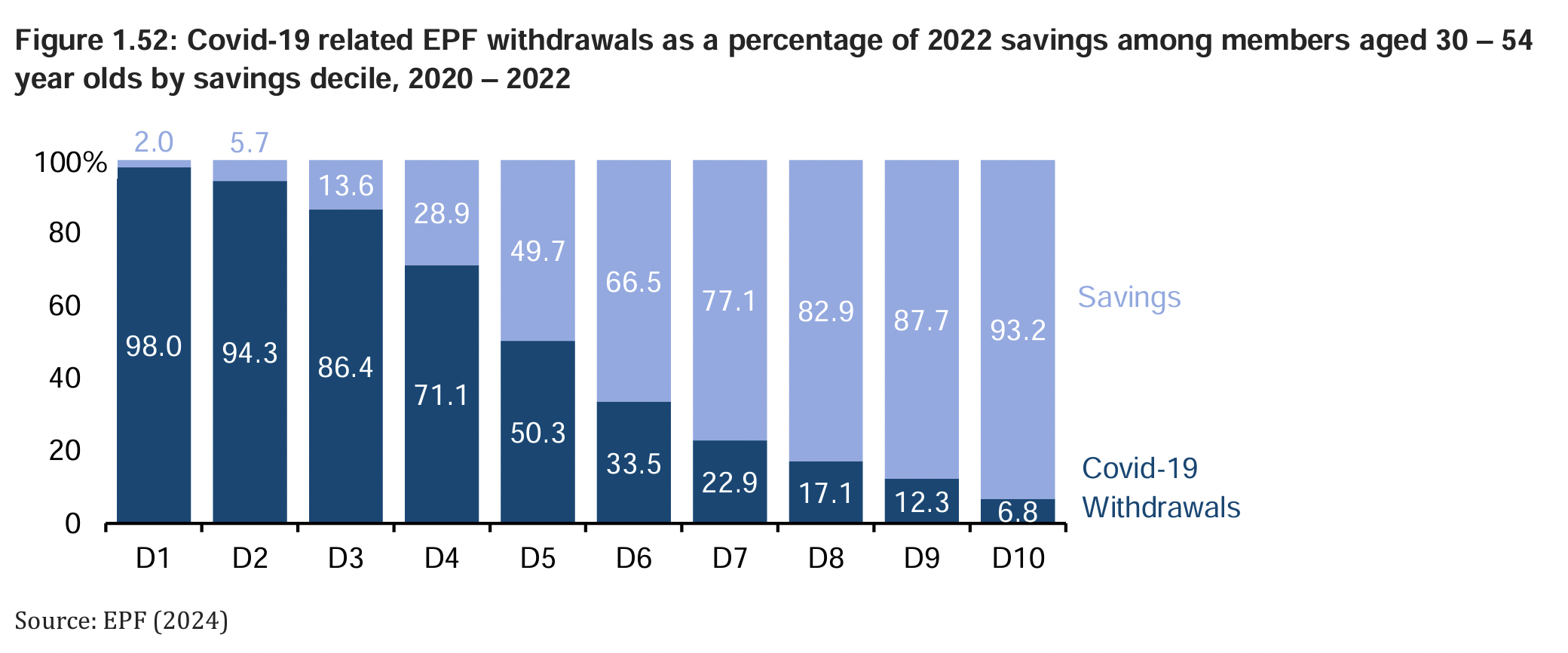

The report also points to a widening disparity in retirement savings between different income groups.

Those in the lowest savings decile (D1) withdrew 98.2% of their EPF savings through government relief programs, which allowed partial withdrawals from EPF savings, compared to 29.7% for the top 10% (D10).

This trend is even more pronounced when considering the 30 to 54 age group, where those in the lowest decile withdrew 98% of their savings, while those in the top decile withdrew just 6.8%, noted Khazanah.

This growing gap highlights the vulnerability of lower-income EPF contributors, who are at a much higher risk of facing financial instability during retirement.